income tax rates 2022 federal

There are seven federal income tax rates in 2022. There are seven federal tax brackets for the 2021 tax year.

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday.

. The IRS tax tables MUST be used. 2021 - 2022 Income Tax. There are still seven tax rates in effect for the 2022 tax year.

The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. The 2022 federal income tax rates are the same for income earners as they were in 2021ranging from 10 to 37. The Federal Income Tax is a marginal income tax collected by the Internal Revenue Service IRS on most types of personal and business income.

The federal income tax consists of six. California residents can face a combined state and federal income tax rate beyond 50 on income that falls into. 10 12 22 24 32 35 and 37.

It is increasing by 900 to 13850 for single taxpayers and by 1800 for married couples to 27700. Federal Tax Rates and Brackets. These are the rates for.

Single filers may claim 13850 an increase. This is a jump of 1800 from the 2022 standard deduction. 1 Lets look at the rates youll use to figure out how much.

There are seven federal tax brackets for tax year 2022 the same as for 2021. Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. For heads of household the 2023 standard deduction will be 20800.

Your bracket depends on your taxable income and filing status. The income brackets though are adjusted slightly for. The federal government sets the 153 payroll tax rate which is paid by both the employer and the employee.

The standard deduction will also increase in 2023 rising to 27700 for married couples filing jointly up from 25900 in 2022. As noted above the top tax bracket remains at 37. The seven tax rates remain unchanged while the income limits have been.

The federal income tax rates remain unchanged for the 2021 and 2022 tax years. Using the 2022 regular income tax rate schedule above for a single person Joes federal income tax is 5187. 43500 X 22 9570 - 4383 5187.

10 12 22 24 32 35 and 37. The change is based on the Consumer Price. For the tax year 2023 the standard deduction amounts and income tax brackets will be adjusted for cost-of-living adjustments.

The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code. When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The table below shows the tax brackets for the federal income tax and it reflects the rates for the 2021 tax year which are the taxes due in early 2022. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. The employer is responsible for paying 765 of payroll tax and the employee.

Income Tax In The United States Wikipedia

The Truth About Tax Brackets Legacy Financial Strategies Llc

2021 2022 Federal Income Tax Brackets And Rates Wsj

Corporate Taxes Less Less And Less Dollars Sense

Federal Income Tax Brackets For Tax Years 2022 And 2023 Smartasset

2021 2022 Tax Brackets And Federal Income Tax Rates

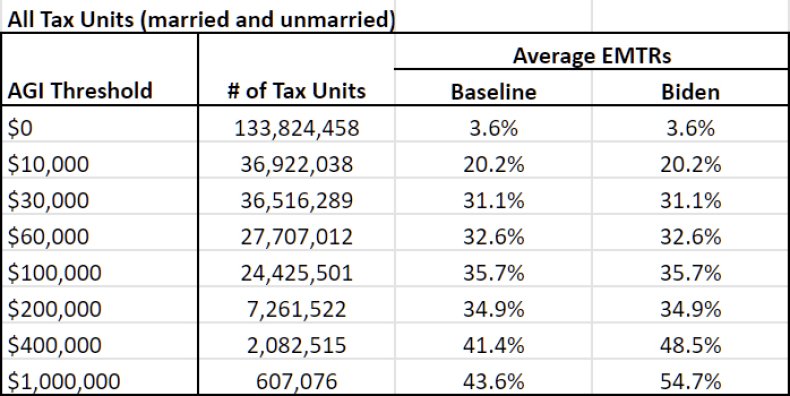

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

2021 And 2022 Federal Income Tax Brackets And Tax Rates Ramseysolutions Com Tax Brackets Income Tax Brackets Federal Income Tax

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

2022 Federal State Payroll Tax Rates For Employers

2020 Vs 2021 Vs 2022 Federal Income Tax Brackets Flsv Frankel Loughran Starr Vallone Llp

Kick Start Your Tax Planning For 2023

2022 Income Tax Brackets And The New Ideal Income

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

2022 2023 Tax Brackets Rates For Each Income Level

Tax Brackets For 2021 And 2022 Ameriprise Financial

2021 2022 Tax Brackets And Federal Income Tax Rates

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

Amazon Avoids More Than 5 Billion In Corporate Income Taxes Reports 6 Percent Tax Rate On 35 Billion Of Us Income Itep